🧠 What's Your Style?

When it comes to stock trading, what IS your style of trading?

What are you really hoping to achieve by risking your hard-earned money on stocks that may—or may not—deliver a profitable outcome?

I used to chase the big one. The next Microsoft. The next Facebook. I thought success meant finding that miracle stock that would explode overnight. But time and experience taught me otherwise. Those miracles do happen—but only over long cycles of ups and downs, splits and reverses, good news and bad news. And they rarely arrive when you expect them.

As a retired programmer, I’ve spent years solving problems with logic and code. But when I discovered a tool like nothing I’d ever seen before—Microsoft Copilot—everything changed. I began asking questions, writing code, asking better questions, rewriting code, experimenting, testing, and re-testing.

After hundreds of hours of work, collaboration, and iteration, I built something I believe in: the Golden Goose Scanner.

I started this project 6–7 months ago. And in the last 3 months, I’ve been making consistent, reliable profits using only the lists generated by my scanner. No hype. No guesswork. Just behavioral logic, tension zone tracking, and disciplined execution.

Now I’m offering that option to you.

Everyone must do their own due diligence when it comes to risking money in the market. But this is my story—and this is the tool that changed the way I trade.

🧠 How the Golden Goose Scanner Works

The scanner runs in two distinct phases, each designed to surface high-probability setups with behavioral precision.

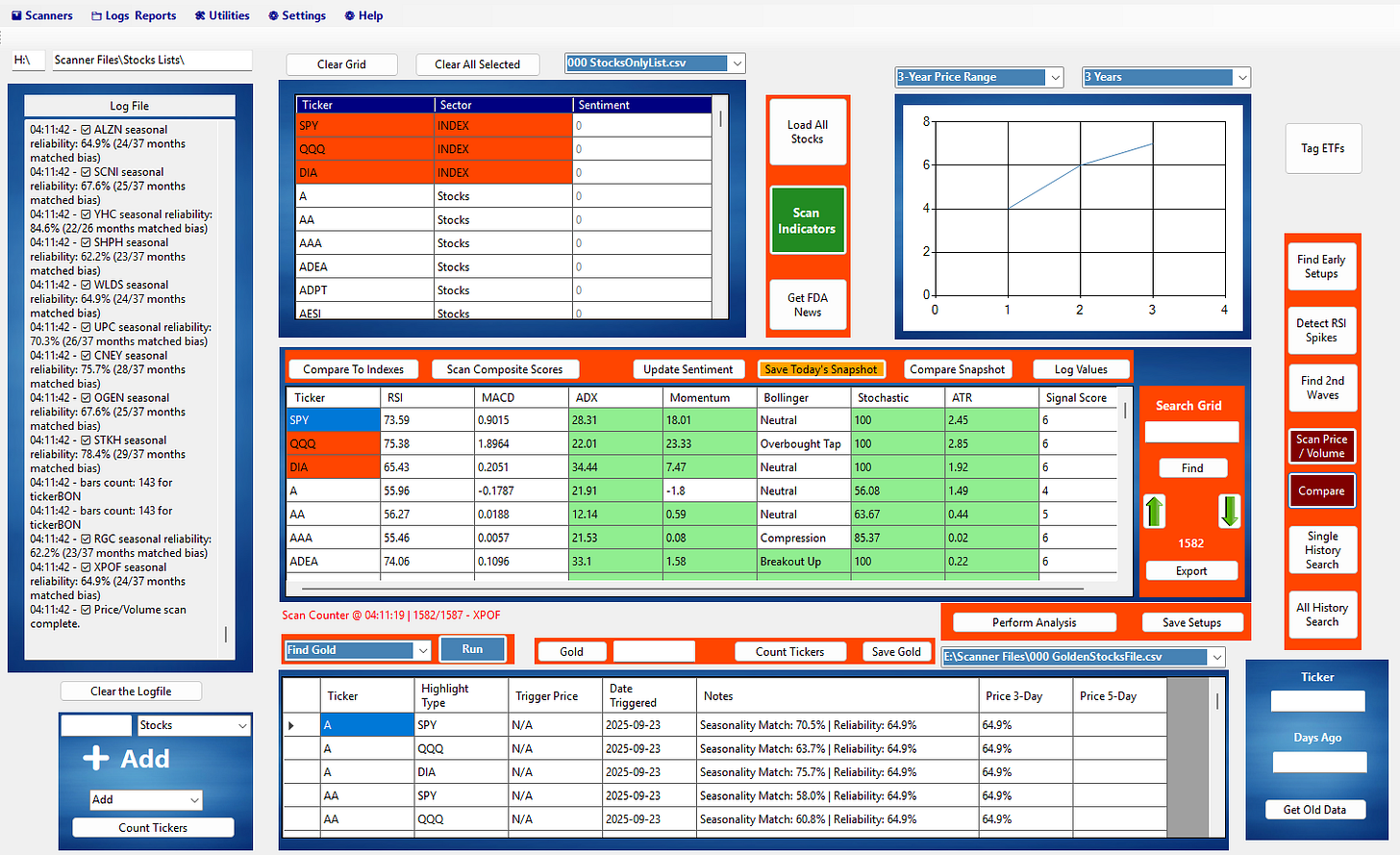

Phase One: Market Context & Seasonal Profiling

Calculates all core technical indicators across your stock universe.

Identifies how each stock behaves relative to major market indexes.

Tracks monthly seasonality and recurring behavioral patterns.

Transfers this contextual intelligence into the Golden Goose engine.

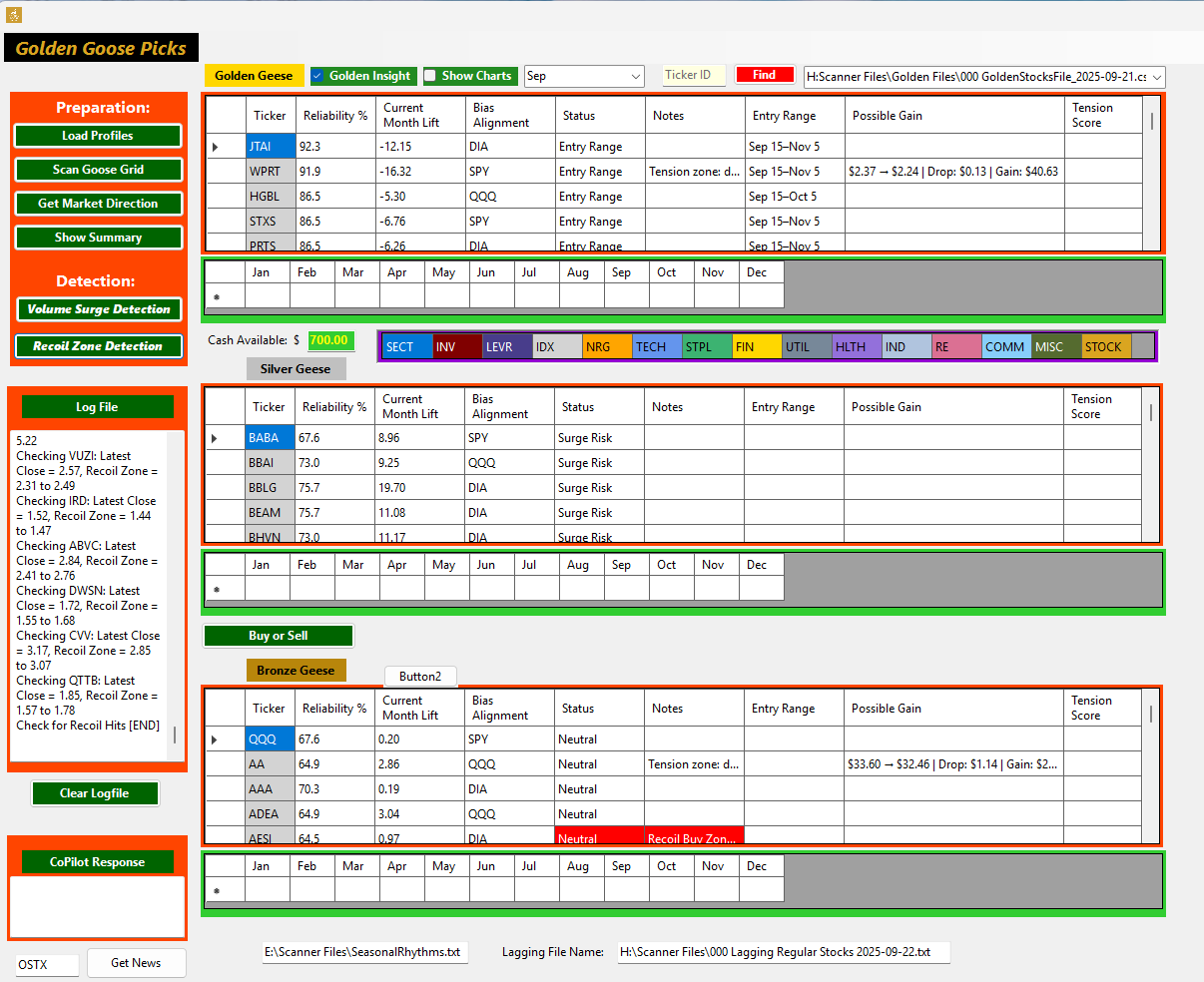

Phase Two: Behavioral Signal Extraction

Filters for stocks with a solid technical foundation.

Flags price and volume surges that exceed their 10-day averages.

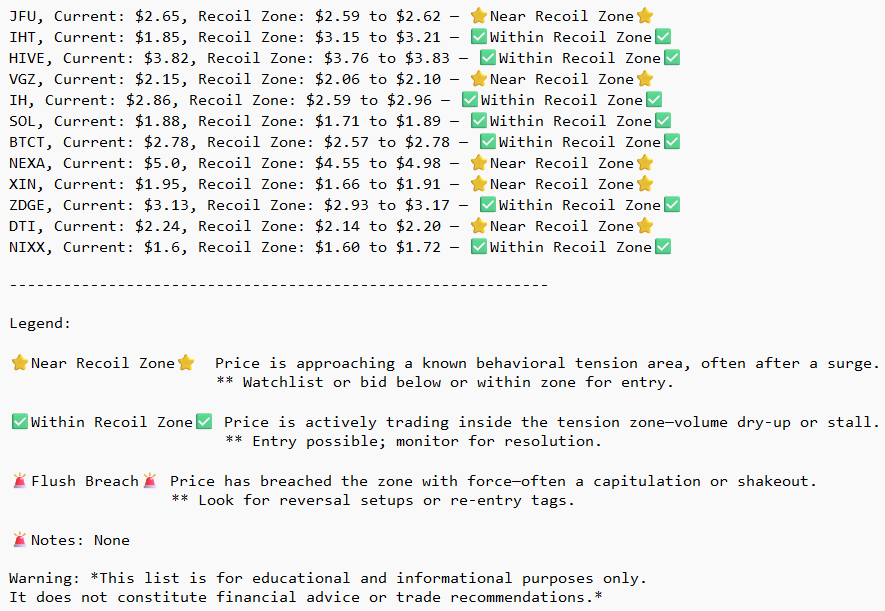

Calculates recoil zones—a behavioral tendency most stocks follow after a run-up.

Prints out possible entry points based on tension, compression, and setup maturity.

This isn’t just scanning for momentum—it’s profiling behavior, tagging tension, and surfacing setups that align with real-world execution.

🖼️ Scanner Phase One: Contextual Profiling

Calculates indicators, tracks seasonal behavior, and maps index correlation.

🧠 Scanner Phase Two: Behavioral Signal Extraction

Flags price/volume surges, calculates recoil zones, and prints entry candidates.

Final Output (Weekly with mid-week updates):

🪶 Why It Matters

These aren’t just technical setups—they’re behavioral patterns that repeat across market cycles. Flush traps, compression zones, and recoil setups are tagged in real time, helping you act with precision and confidence.

🧠 Thanks for viewing!!

Jack

I'm not a millionaire but I won't say no to it.